Meeting Customers’ Expectations

Banking and financial institutions the world over have increased pressure on them to meet customers’ needs for both ease of use and security when it comes to their most important data. Financial institutions are being pushed further and further to revamp their solutions to keep up with the digital age, yet for even standard banking, this data must always be available to allow customers to make simple purchases, and cash has almost become a thing of the past.

Keeping Services Available 24/7

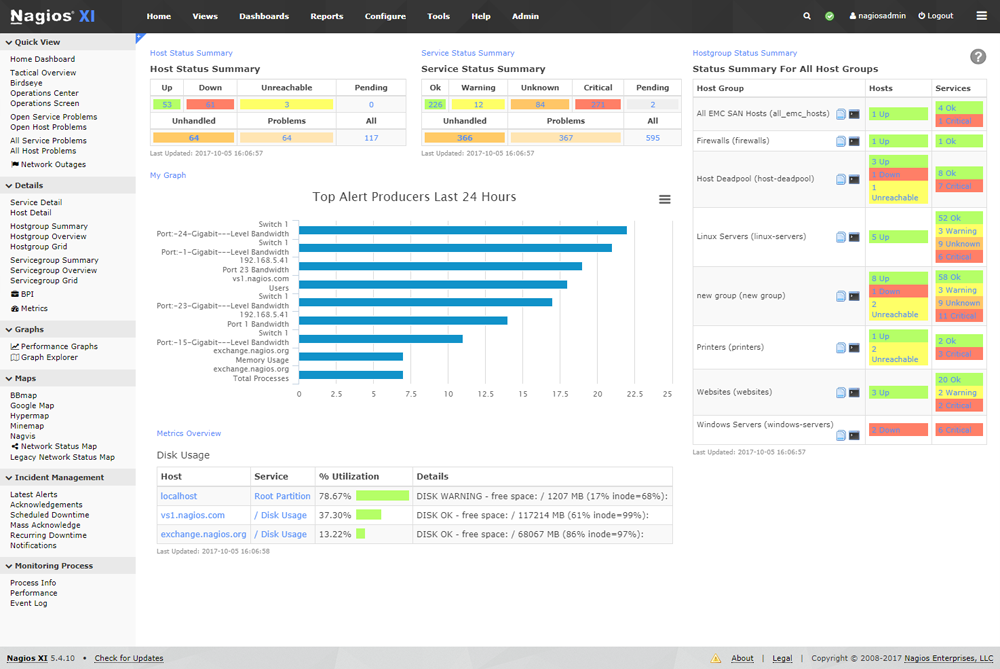

It doesn’t matter if you are a local credit union or a multinational banking giant; you need to make your services available to your clients 24 hours a day. By deploying a Nagios solution, leading financial institutions benefit from Nagios’ comprehensive monitoring and alerting capabilities. By providing proactive alerts, downtime can be drastically reduced or often prevented altogether, keeping systems online and the supply chain moving.

Monitoring key performance metrics provides invaluable information necessary to plan and budget for future system upgrades or prepare for required maintenance. By implementing Nagios, local and global banks can receive instant notifications of website and system outages that can affect their public image and operational efficiency, helping them meet customer expectations. Once alerted, IT staff can resolve problems more quickly, thus lessening the impact of outages and reducing or eliminating downtime.

Banking and Financial Institutions Implementing Nagios Can:

- Improve customer expectations

- Improve website availability

- Improve public visibility and credibility

- Improve ROI on IT systems

- Improve operation efficiency

Further Reading

More Information

Recommended Software: Nagios XI

Learn More | Demo

Nagios XI is the most powerful and trusted infrastructure monitoring tool on the market. Millions of users and thousands of companies, ranging from Fortune 500s to small business owners, trust Nagios XI to get the job done.